Buying a home is an exciting and significant milestone in anyone’s life. Along with that comes a lot of industry words and mortgage jargon. For example, you may hear your adviser or estate agent talk about “the chain.” Most homebuyers will end up in a chain, and it’s important to understand what to expect.

If you’re not sure what the homebuying chain is, don't worry. We’re here to break down its various stages, potential challenges, and how you can make the most of it to ensure a smooth and successful transaction.

The homebuying chain explained

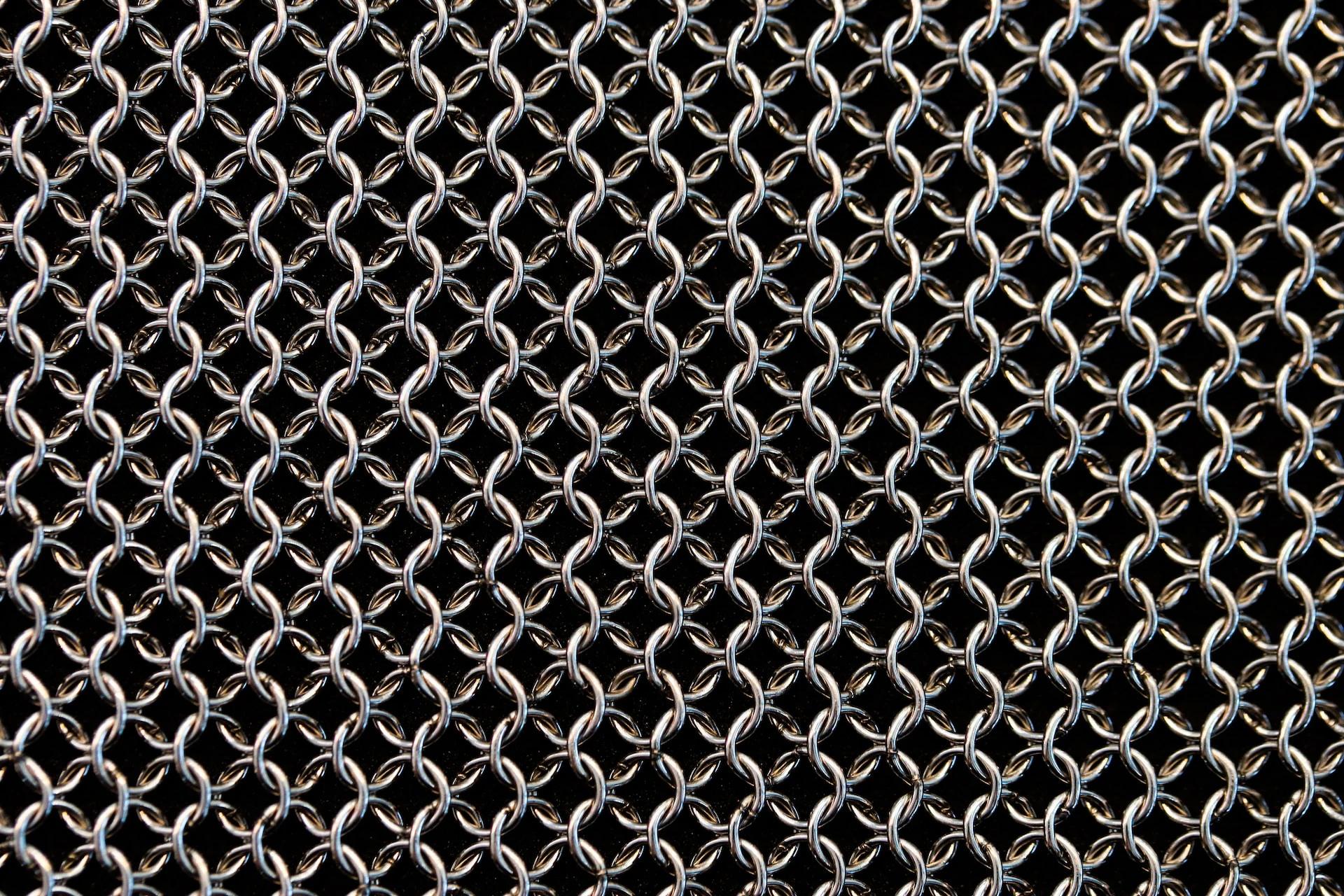

The homebuying chain refers to a sequence of interconnected property transactions. These naturally occur when people are buying and selling homes and usually involves multiple buyers and sellers, each reliant on the other person's successful completion in order to move along with theirs.

The chain can vary in length and complexity, ranging from a simple chain of two buyers/sellers to a more intricate web, involving several buyers and sellers.

Types of homebuying chains

It can be challenging to quantify a simple chain for a complex one, as there can be so many moving parts. That being said, if we visualise a journey in our minds, we can pick out where challenges and obstruction turn a simple homebuying chain into a complex one.

The simple chain

Julia is a first time buyer, buying a house from Shane, who plans to buy a house from Rajesh, who is moving into a new build. In this scenario, Julia is not waiting to sell her previous home, Shane only needs to wait for Rajesh to move into his new build, and as Rajesh is not waiting for anyone else, he is only waiting on the developer.

If there are no building delays, this should be a relatively straightforward chain.

The complex chain

In a complex chain, there are more moving parts.

Julia is not a first time buyer and is buying a new property from Shane. Shane is buying from Rajesh, who is purchasing an existing property, which has issues with a survey. Check out our article to learn more about surveys and what you need to know.

Following the survey issues, the homeowners in Rajesh’s new property are struggling to buy a new house, and these issues combined cause delays for everyone down the chain.

Because Rajesh can’t complete, neither can Shane and neither can Julia.

It’s important to note that a homebuying chain can involve upwards of ten or more people, and often do, so it can get complicated really quickly.

All dates are contingent on someone else’s completion date, so disruptions can cause significant waves throughout. If you are involved in a delayed chain, you’ll have to decide if you want to remain in it, either by completing to secure the sale, or spending money renting. If you decide to wait it out, there’s still the risk of a buyer or seller dropping out, which runs the risk of collapsing the chain.

The different stages of the homebuying chain

Once you’re at a stage where you’re mortgage ready, it’s time to start viewing properties and taking this first step means that you’re stepping into the homebuying chain. What are the different stages you’ll experience?

The property search

The homebuying journey usually starts with looking for a property that fits the bill. At this point, you will usually work with estate agents, browse online listings, and attend viewings for the desired home.

Offer and acceptance

Once you find a house you want to buy, you’ll typically make an offer through your estate agent. If the seller accepts your offer, an official agreement is established, known as the “subject to contract” stage. This agreement doesn’t mean the sale itself is legally binding, only that both parties have agreed to the offer.

Conveyancing and surveys

Once you have come to an agreement with the seller, you will appoint a solicitor or licensed conveyancer to handle the legal aspects of the transaction. The conveyancer will conduct a property search, review documents, and arrange surveys to identify any potential issues or defects.

Mortgage application

Most buyers require a mortgage to finance their property purchase. At this stage, you will submit a mortgage application through your adviser, who will work with you and the lender to establish your eligibility based on factors like credit history, income, and the property valuation.

Exchange of contracts

Once all legal requirements have been satisfied and you have had your mortgage accepted, you and the seller will exchange contracts. At this stage, both parties are legally bound to the transaction and a completion date is officially set.

Completion and moving day

Completion day is when funds are transferred and ownership of the property officially changes hands. You will get the keys to your new home and you can move in.

Challenges in the homebuying chain

Let’s assume everything went smoothly in the above steps and you encountered no challenges! This is the ideal situation and for the most part, this is what will happen. There are, however, some potential challenges to be aware of.

Breakdowns and delays

Any drawn-out process is susceptible to delays and the homebuying process is unfortunately no exception. If any involved party suddenly encounters financial difficulties, legal complications, or has a change of heart, it can disrupt the entire chain. This can cause frustration and even potential financial loss.

It’s not always possible to avoid, especially if you’re a little further along the chain, but it’s always best to handle these issues with as much patience as possible.

Gazumping and gazundering

It doesn’t get more jargony than gazumping and gazundering. However, the terms are definitely worth knowing and avoiding where you can.

Essentially, gazumping happens when a seller accepts a higher offer from another buyer, even if they have already accepted an offer from you. Gazundering, on the other hand, happens when a buyer lowers their offer right before the exchange of contracts.

These practices can disrupt the entire chain and lead to renegotiations or even the abandonment of the deal, and they’re not illegal.

You can avoid the repercussions of being gazumped by having home buyer protection insurance, which will help you recoup financial losses. You can also spend some time getting to know the sellers, or even consider a “lock-out agreement,” which is essentially a contract stating that the buyer has exclusive rights to the property within a certain period.

Finally, you could ask the sellers or estate agents to take the property off the market to help avoid this. Some estate agents will do this as a matter of course, but it is worth checking that they have actually followed through.

How to avoid getting into a chain

There are a few ways to avoid being in a chain, or at least avoid being in a long one. While it’s not always possible, there are steps you can take:

- Choose a chain-free buyer

- Look for a chain-free seller

- Consider new-build properties

- Agree on a date

Here are some steps for keeping a homebuying chain moving, which can help mitigate any potential problems down the line:

- Work with an experienced estate agent and solicitor

- Speak to any representatives regularly

- Get your finances in place early

- File everything and document all processes

- Have copies of all documents to hand

- Sign and return your paperwork promptly

- Put clauses into contracts stating all dates

Streamlining the homebuying process

Understanding what the homebuying chain is crucial for buyers and sellers navigating the property market. While knowing what to expect can certainly make the process easier and more efficient, it always helps to have a professional at your side to help you when things get a bit complicated.

Whether you’ve already found your dream home and have made an offer or are still browsing online listings, we recommend getting in touch with a mortgage adviser for expert advice, guidance, and support.

No question is too big or small and we’re always here to help!

Important information

Your home may be repossessed if you do not keep up repayments on your mortgage.

There may be a fee for mortgage advice. The actual amount you pay will depend on your circumstances. The fee is up to 1% but a typical fee is 0.3% of the amount borrowed.