Who we are and

what we do

Mortgage Advice Bureau is particularly active in the estate agency and new build sectors both of which are major lead sources for our partner firms. MAB is the only mortgage intermediary brand with UK wide adviser coverage for face to face advice, alongside a rapidly increasing capacity for telephone advice. This USP is being leveraged to secure major regional and national lead sources that will be serviced by MAB branded distribution. This is a new initiative supported by developments in technology, that is already gaining momentum, and adding further value to our key branded business partners as well as those considering joining MAB.

MAB has long term contractual strategic partnerships with its ARs, and our proposition is designed to attract high quality medium to larger sized firms, that are forward thinking and want to grow their business and market share. Once an AR joins MAB, we work closely with them to help them grow and achieve their ambitions.

The Group maintains all regulatory FCA permissions

The Group’s network offers advice on over 12,000 mortgage products from over 90 lenders, including residential and buy-to-let mortgages. The Legal & General Mortgage Club, one of the largest and most successful UK mortgage panels, is highly respected by lenders and has been adopted by the Group as its mortgage panel of choice.

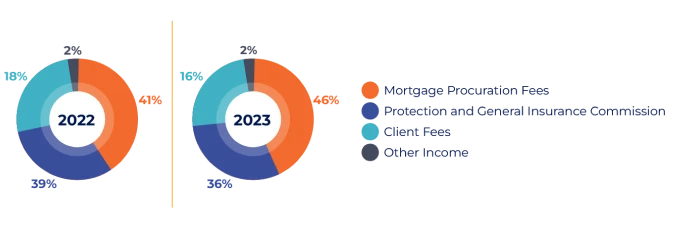

We operate a revenue share model with our ARs and therefore our interests are aligned with those of our ARs. Our revenue consists predominantly of procuration fees from lenders on the arrangement of a mortgage, insurance commissions from our panel of insurers on protection or general insurance policies being arranged for our customers, and also client fees which are paid by the majority of underlying customers for the advice that they receive. The proportion of revenue falling into each category for the last two financial years is as follows:

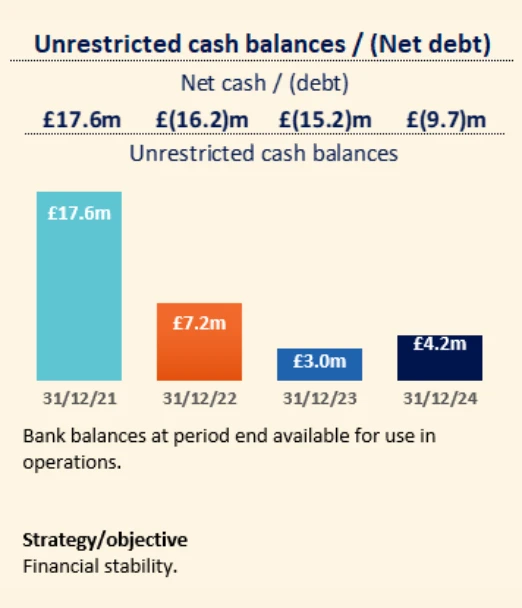

MAB’s recognised revenue consists mainly of mortgage procuration fees, insurance commission and client fees, and this is all received by MAB. We then pay our ARs their share of revenue on a weekly basis, and then they pay the advisers they employ. As a result we have a cash generative and capital light business model, which enables us to pay out 90% of our profits after tax as dividends. MAB has a risk mitigated, scalable model and carries no debt.

Financial Track Record

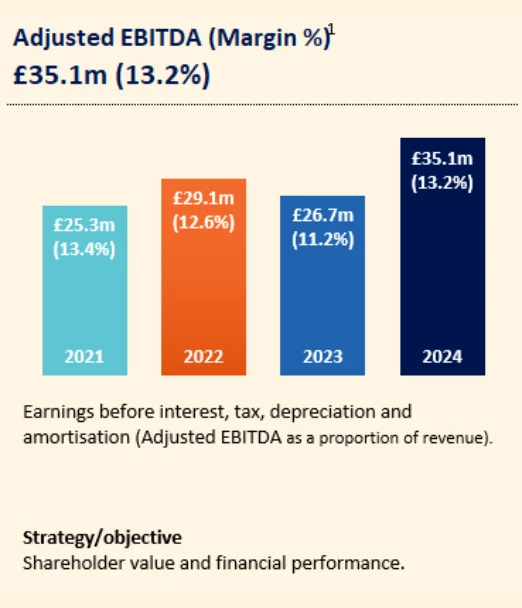

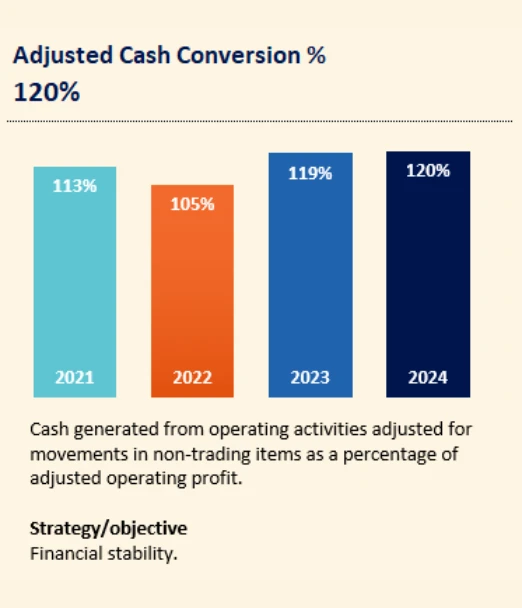

We measure the development, performance and position of our business against a number of key indicators:

1 Excludes directly authorised advisers, MAB's later life advisers and advisers from associates in the process of being onboarded under MAB's AR arrangements. Includes Fluent's second charge, later life and bringing advisers who have higher revenue per adviser that first charge advisers.

*In addition to statutory reporting, MAB reports alternative performance measures ("APMs") which are not defined or specified under the requirements of International Financial Reporting Standards ("IFRS"). The Group uses these APMs to improve the comparability of information between reporting periods, by adjusting for certain items which impact upon IFRS measures, to aid the user in understanding the activity taking place across the Group's businesses, APMs are used by the Directors and management for performance analysis, planning, reporting and incentive purposes. A summary of APMs used and their closest equivalent statutory measures is given in the Glossary of Alternative Performance Measures.

Mortgage Advice Bureau Annual Report 2022